Understanding The PPP List For Your Business

For many small businesses, finding a bit of financial breathing room can feel like a big challenge, you know. The Paycheck Protection Program, often called PPP, came about as a way to help companies keep their team members on the payroll during some tough times. It was set up through the CARES Act, which was a piece of legislation put in place to offer support when it was really needed. This program, in a way, aimed to give a hand to those who were struggling to maintain their workforce, helping them cover important costs like wages and benefits. It was a pretty direct approach to keeping people employed and businesses going, so.

The Small Business Administration, or SBA, put this program into action, getting a lot of help from various groups to make it happen. Their role was to oversee the whole thing, making sure the funds got to the right places and that the rules were followed. It was, in some respects, a massive undertaking, needing a lot of coordination to assist a wide range of companies across the country. This effort meant working with lenders and other partners to distribute the financial aid that businesses needed to stay open and keep their staff working, that.

One of the biggest attractions of this program was the possibility of getting the money forgiven, which meant borrowers might not have to pay it back. This feature was a huge relief for many business owners, as it turned a loan into something more like a grant if certain conditions were met. It helped ease the financial pressure on companies, allowing them to focus on their operations rather than worrying about a large debt looming over them. The idea was to give businesses a real chance to recover without being burdened by new financial obligations, apparently.

Table of Contents

- What is the Paycheck Protection Program (PPP) all about?

- Getting Your PPP Loan Forgiven – Is That Possible?

- How Does the Application Process Work for the PPP List?

- What Can PPP Funds Be Used For, Really?

- Changes of Ownership and Your PPP Loan – What You Should Know?

- Support and Help for Your PPP Journey

- The PPP Program – Is It Still Around?

- Other PPP Information

What is the Paycheck Protection Program (PPP) all about?

The Paycheck Protection Program, as we mentioned, was a government effort meant to give a financial lift to small businesses. It was put in place very quickly, basically, to deal with the economic slowdown caused by the recent worldwide events. The main idea behind it was to help companies keep their workers employed and avoid large-scale job losses. This meant providing money that businesses could use for things like salaries, wages, and other employee-related expenses, you know.

The program was run by the Small Business Administration, which is a government body that usually helps small businesses grow and succeed. For PPP, they got help from many different places, including banks and other financial groups, to get the money out to businesses. It was a big undertaking, requiring a lot of people to work together to make sure the program could reach as many eligible companies as possible. This collaborative approach was, in a way, what made the program work on such a large scale, so.

How the PPP list helped businesses

The way the PPP list helped businesses was by giving them a direct line to funds that could keep their operations going. For many, it was the difference between closing their doors and staying open, basically. The money allowed them to cover their payroll, which is often the biggest cost for a small company. This meant employees could continue to receive their regular paychecks, which was good for families and for the wider economy, too.

It also helped businesses manage other important costs, as we will talk about a little later. This included things like rent for their workspace or the interest on their business mortgage. Having this financial cushion meant businesses could focus on adapting to new ways of working rather than worrying about immediate financial collapse. It was, in some respects, a way to stabilize things for a lot of smaller companies, you know.

Getting Your PPP Loan Forgiven – Is That Possible?

A big part of the Paycheck Protection Program that made it so appealing was the chance for borrowers to have their loans forgiven. This meant that if you used the money for the right things and met certain requirements, you might not have to pay it back at all. It was, arguably, a very helpful feature for many business owners, turning what could have been a debt into a direct financial benefit. The idea was to reward businesses for keeping their employees on staff and for using the funds as intended, so.

The Small Business Administration set up a special online place, a portal, to make the forgiveness process smoother for those who borrowed money. This portal was meant to make it easier for companies to send in their requests for forgiveness and for the SBA to go through them. It was a way to streamline things, basically, so that businesses could get their forgiveness decisions without too much trouble. This made it less of a burden for companies trying to get their financial house in order, you know.

The PPP list of forgiveness steps

When it came to the PPP list of forgiveness steps, there were a few things to keep in mind. Borrowers could put in their request for forgiveness any time up to five years from the day the SBA gave them their loan number. This gave businesses a good amount of time to get their paperwork together and make sure they met all the rules. It was, in a way, a flexible timeline designed to help companies manage their responsibilities, so.

However, there was also a more immediate deadline for some. If borrowers did not put in their request for forgiveness within 10 months after the time period they used the funds, they would then have to start making payments on the loan. This was a pretty important detail to remember, as missing that 10-month mark meant the loan would turn into a regular debt that needed to be paid back. It was a way to encourage timely applications, basically, while still giving some wiggle room, you know.

How Does the Application Process Work for the PPP List?

The application process for the PPP list involved lenders playing a key role. The Paycheck Protection Platform was the system that allowed lenders to send in their requests for PPP loans on behalf of businesses. This platform also let lenders submit their decisions about whether a loan should be forgiven to the SBA. It was, in some respects, the central hub for all the paperwork and decisions related to these loans, making sure everything was tracked properly, so.

For businesses themselves, the process often started with registering on a portal. This portal, made available by the US Small Business Administration, was there to make the forgiveness processing simpler for those who borrowed PPP money. After getting registered, you could use this easier way to send in your forgiveness request. It was all about making the steps as clear and straightforward as possible for the people who needed the help, you know.

What the PPP list means for applying

What the PPP list means for applying is that there was a structured way to get your request in. Lenders were the ones who worked directly with the SBA system, acting as the go-between for businesses. This meant that a business would apply to their bank or a qualified lender, and that lender would then put the request through the official platform. It was a pretty organized system, designed to handle a very large number of applications quickly, basically.

The availability of a specific portal for forgiveness applications also meant that businesses had a clear path to follow once they were ready to ask for their loan to be cleared. This centralized system was meant to reduce confusion and make sure all the necessary information got to the right place. It was, in a way, a helpful tool for both borrowers and the government agencies involved, streamlining a complex financial process, you know.

What Can PPP Funds Be Used For, Really?

When it came to using the money from a PPP loan, there were specific rules about what it could cover. For what were called "First Draw PPP loans," the money was mainly meant to help pay for payroll costs. This included things like wages, salaries, and benefits for employees. The idea was to keep people employed and receiving their paychecks, which was a core goal of the program, you know.

But the funds could also be used for other important business expenses. This included paying for the interest on a business mortgage, if you had one. It also covered rent for your business location and utility bills, like electricity and water. Beyond that, the money could go towards costs related to keeping workers safe, especially during the health situation that prompted the program. These were all ways to help businesses stay open and functioning, so.

The PPP list of eligible costs

The PPP list of eligible costs for "Second Draw PPP loans" was quite similar to the first round. Again, the main focus was on helping fund payroll costs, including all the benefits that go along with having employees. This continued to be the most important use of the funds, reflecting the program's aim to protect jobs, basically. It ensured that businesses could keep their teams together even when revenue might have been lower than usual, you know.

Just like with the first loans, these second loans also allowed for other essential business expenses to be paid. This meant money could be used for mortgage interest payments, rent for your business space, and utility bills. Worker protection costs were also still on the list of approved uses. This broad set of allowed expenses meant that businesses had some flexibility in how they used the funds to keep their operations stable, so.

Changes of Ownership and Your PPP Loan – What You Should Know?

Sometimes, a business that received a PPP loan might go through a change in ownership. This could mean the business is sold, or there's a significant shift in who owns it. The Small Business Administration put out a special notice about PPP loans and these changes of ownership. This notice was very important for businesses and lenders to understand, basically, as it laid out specific procedures that needed to be followed, you know.

The purpose of this notice was to give clear information about the steps required when a business with a PPP loan changed hands. It outlined what needed to happen to make sure the loan remained valid and that any forgiveness process could still go forward. This was to prevent confusion and make sure that the program's rules were consistently applied, even when a business's structure shifted. It was, in a way, about maintaining order in a complex situation, so.

A PPP list of ownership considerations

A PPP list of ownership considerations would include making sure that all parties involved were aware of the rules. The notice from the SBA was there to guide businesses and lenders through these situations. It helped them understand what documents might be needed, what approvals might be required, and how the loan itself would be handled after an ownership change. This was very important for avoiding problems down the line, basically.

The rules were put in place to protect the integrity of the program and ensure that funds continued to be used for their intended purpose, even if the business had new owners. It meant that the responsibilities tied to the PPP loan, including the potential for forgiveness, would transfer in a structured way. This helped maintain fairness and accountability within the program, you know, even as businesses went through big transitions, so.

Support and Help for Your PPP Journey

Getting a PPP loan and then going through the forgiveness process could feel like a lot to handle for some business owners. Recognizing this, the Small Business Administration made sure to offer help and support. They provided free counseling and training events specifically designed to assist businesses with the Paycheck Protection Program. This was a way to make sure that companies had access to good information and advice when they needed it most, you know.

These events and counseling services were there to answer questions, explain the rules, and guide businesses through the various steps. It was about making the program more accessible and less confusing for those who were trying to benefit from it. This support was, in some respects, a valuable resource for many small businesses, helping them to correctly apply for loans and forgiveness, so.

Finding assistance with the PPP list

Finding assistance with the PPP list meant knowing that help was available from the SBA. Whether it was about understanding how to apply, what costs were covered, or how to seek forgiveness, there were places to turn for advice. This kind of support was really important for businesses that might not have had a lot of experience with government programs or financial applications, basically.

The availability of free counseling meant that businesses didn't have to pay for expert advice, which was a big help, especially when they were already facing financial pressures. These training events also offered a chance to learn from people who understood the program well. It was, in a way, a commitment from the SBA to help businesses succeed with their PPP loans, you know.

The PPP Program – Is It Still Around?

A question many people might have is whether the Paycheck Protection Program is still active and taking new applications. The simple answer to that is no. The PPP program is closed. This means that businesses can no longer apply for new PPP loans, as the window for applications has ended. It was a program that ran for a specific period of time, designed to address an immediate need during a particular economic situation, so.

While new loans are no longer being given out, the effects of the program are still felt by many businesses that received funds. The process of loan forgiveness, for example, continued for a while after the application period closed. This meant that even though new money wasn't available, the administrative tasks related to existing loans were still ongoing for some time, you know.

The PPP list and its current status

The PPP list and its current status mean that while the program itself is not accepting new requests, its legacy continues. Businesses that received loans are still working through the implications, especially regarding forgiveness. The rules for forgiveness, like the timeline for applying, remained in place for existing borrowers. This was important for those who had received funds to know, basically, so they could complete their process correctly.

The SBA continued to manage the forgiveness process through its portals, even after the program stopped taking new loan applications. This ensured that businesses had a way to finalize their loans and potentially have them cleared. So, while the lending part of the program is over, the administrative side of managing those loans continued for a good while, you know.

Other PPP Information

Beyond the Paycheck Protection Program, the term "PPP" can refer to other things, as seen in various pieces of information. For instance, in Haryana, India, there's something called the "Parivar Pehchan Patra," which is also known as PPP. This is an official website for Haryana's family identification system, offering details and services related to family records and government schemes. People can log into the "mera parivar portal" to manage their family details and get access to various government services in that region, you know.

Then there are other mentions of "PPP" that are not related to financial loans for businesses. For example, the city government of Carmona invited interested parties to apply for qualification and to submit proposals for the development, financing, design, engineering, and construction of certain projects. This also uses the "PPP" shorthand, but it's clearly about public-private partnerships for building things, not paycheck protection, so.

You might also come across information in different languages related to "PPP." For example, there are "Häufig gestellte Fragen für PPP-Darlehensnehmer und -Darlehensgeber," which is German for "Frequently asked questions for PPP borrowers and lenders." Similarly, "પીપીપી ઉધારકર્તાઓ અને ધીરનારો માટે વારંવાર પૂછાતા પ્રશ્નો" is Gujarati for the same thing. These show that the term "PPP" has a wider use and meaning in various contexts and languages, basically, beyond just the Paycheck Protection Program, you know.

A varied PPP list of resources

A varied PPP list of resources shows how the term can pop up in different places. From managing family details in Haryana to city development projects, the letters "PPP" stand for different things depending on the context. It's interesting to see how a short abbreviation can have such different meanings across different sectors and regions. This means that when you see "PPP," it's always good to look at the surrounding words to understand what it's really talking about, so.

The fact that different countries and governments use "PPP" for their own programs highlights how common these kinds of abbreviations are. It shows that while the Paycheck Protection Program was a big deal for small businesses in one area, the same three letters can mean something completely different elsewhere. This is just how language works, basically, with common letter combinations taking on different meanings in different settings, you know.

This article talked about the Paycheck Protection Program, its purpose, how loans could be forgiven, the application process, and what the funds could be used for. It also touched on what happens with changes of business ownership and the support available. Finally, it mentioned the program's current status and briefly explored other uses of the "PPP" abbreviation in different contexts, like the Haryana family identification system and city development projects.

PPP PUBLIC CENTERS – PPP Union

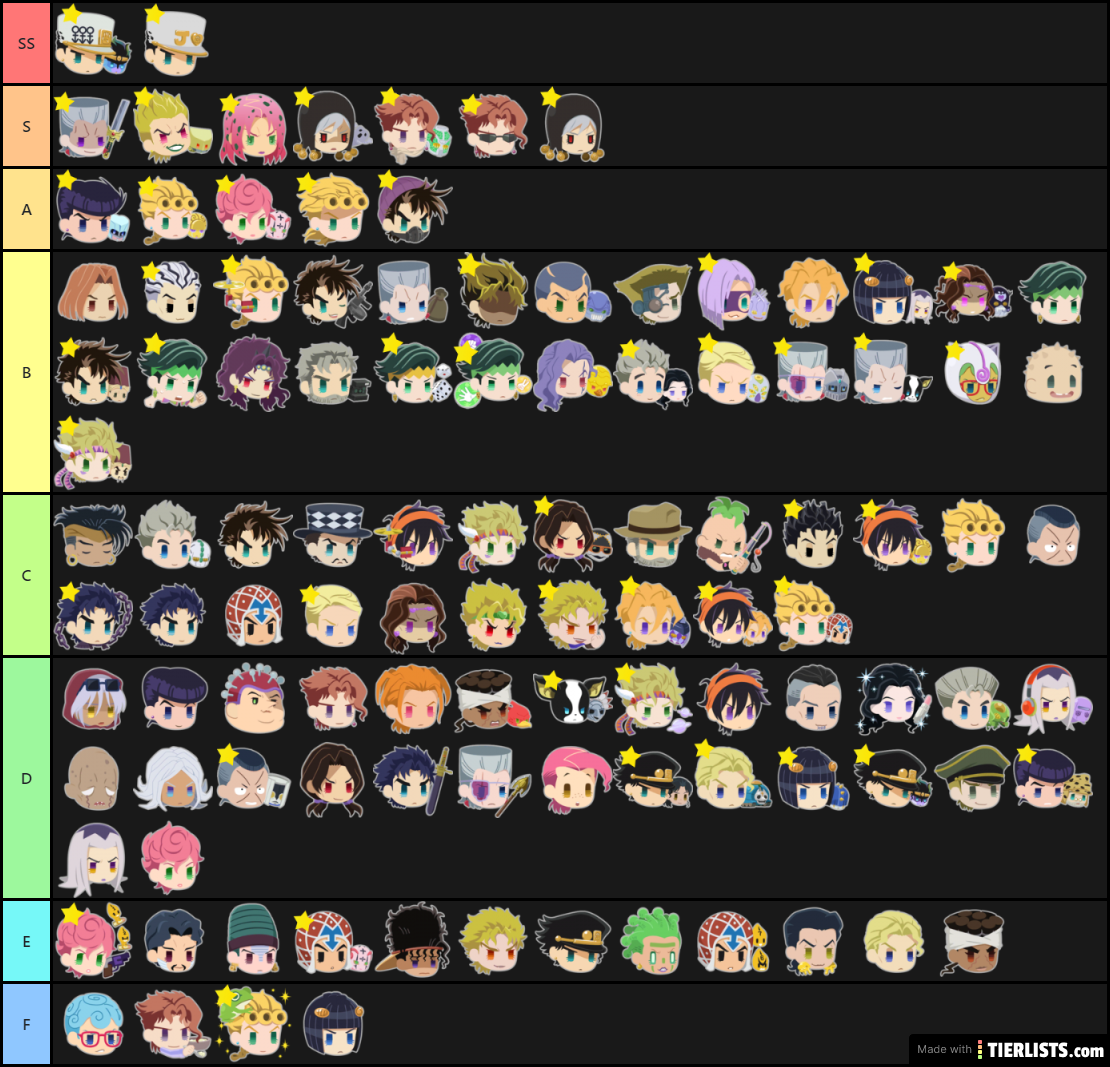

Jojo ppp tier Tier List - TierLists.com

Unveiling The PPP Warrant List: A Comprehensive Guide To Loan