TIAA Retirement Options - Your Future, Secured

Thinking about your future, especially what life might look like when you step away from daily work, is a big deal for many folks. It’s about feeling safe and sound, knowing that your financial picture will remain steady. Finding a reliable partner to help you shape that picture can make all the difference, really. You want to feel confident in the choices you make today for tomorrow.

Many people are looking for ways to make their money work harder for them, and they want to do it with a company that truly understands what it means to plan for the long haul. It's about more than just numbers; it's about peace of mind, too. You might be wondering about different kinds of savings plans or ways to make your money grow, perhaps even considering something like a TIAA CD rate, which some people find interesting.

That’s where TIAA comes into the picture, offering a variety of ways to help you prepare for that time when you’re ready to enjoy life without the daily grind. They aim to help you feel secure about your money, providing different paths to help get you there. It’s a bit like building a strong foundation for your home; you want it to be solid, you know?

Table of Contents

Understanding Your TIAA Account and Its Features

How Does TIAA Help You Build a Secure Future?

Exploring TIAA Solutions Beyond the TIAA CD Rate

Getting Started With Your TIAA Online Access

What If You Need Help With Your TIAA Account?

TIAA's Promise for Your Retirement Security and the TIAA CD Rate

Considering TIAA Stable Value and TIAA Access Alongside the TIAA CD Rate

Connecting With TIAA Experts for Your Retirement Plan

Understanding Your TIAA Account and Its Features

When you have an account with TIAA, it's pretty much set up to give you a clear picture of your financial situation, which is actually very helpful. You can easily check on your money, see what’s coming in and going out, and just generally keep an eye on things. This ability to see your balances at a glance gives you a good sense of where you stand financially, you know, at any given moment. It’s a bit like checking the fuel gauge in your car; you want to know how much is there.

Beyond just looking at your money, these accounts also let you take an active part in handling your financial holdings. You can make choices about where your money goes and how it's looked after, which is really important for your long-term goals. It means you have a say in how your savings are working for you, and that can feel pretty good. So, you're not just a passive observer; you're more like the person steering the ship, in a way.

And if you ever feel a bit unsure about what steps to take next, there's also the chance to get some guidance. This means you don't have to figure everything out on your own, which can be a huge relief for many. Having someone to talk through your options with, someone who understands the ins and outs of financial planning, can make a big difference as you try to build a strong financial future. It's like having a helpful co-pilot, if you will, to assist you along the way.

How Does TIAA Help You Build a Secure Future?

TIAA has a strong belief that everyone deserves to feel financially safe and sound, especially as they get older and think about leaving the workforce. It’s a core idea for them, really, that each person should have the chance to enjoy their later years without constant money worries. This perspective shapes how they approach everything they do, making security a central theme. It’s about building a future where you can relax, perhaps a little more than you do now.

They offer a whole range of ways to help you get there, from different kinds of annuities that can provide steady income to various retirement plans that help you save up over time. It's not just about one type of solution, but a collection of tools designed to fit different needs and situations. So, you might find something that fits just right for what you're trying to achieve, which is pretty neat.

They also help with figuring out your overall money picture, giving advice on how to plan for the future, and even assisting with putting your money into various things to help it grow. This broader approach means they look at your whole financial life, not just one small piece of it. It’s like having a big map that shows you all the different paths you could take to reach your destination, you know?

Wealth management is another area where they step in, helping you manage your money so it works for you in the best possible way. This can involve making sure your money is handled smartly, aiming for growth while also keeping an eye on stability. It’s about helping your assets serve your long-term goals, giving you a bit more control over your financial destiny. Basically, they try to help you make the most of what you have.

Exploring TIAA Solutions Beyond the TIAA CD Rate

When people think about saving money, they often consider different ways their funds can grow, and some might even wonder about options like a TIAA CD rate. It’s a common thought, looking for places where your money can earn a bit more while staying safe. However, TIAA offers many other kinds of solutions that are worth looking into, perhaps even more so for retirement planning.

For example, annuities are a big part of what they do, providing a way to turn your savings into a regular stream of income later in life. This can be a very appealing option for those who want a predictable paycheck in retirement. It's a bit like setting up your own personal pension, ensuring you have money coming in no matter what, which can be quite comforting.

Then there are the various retirement plans, which are designed to help you put money aside consistently, often with some tax advantages. These plans are built to help your savings build up over many years, so that when retirement finally arrives, you have a solid nest egg. They really focus on helping you save smart for the long haul, you know, making sure you’re prepared.

Financial planning is another key area, where experts can help you create a personalized roadmap for your money goals. This isn't just about saving for retirement; it's about looking at your whole financial picture, from budgeting to investing, to make sure everything lines up with what you want to achieve. It’s a very personal process, tailored to your unique situation.

And of course, they help with general investing, finding different ways to put your money to work so it has the chance to grow. This could involve various types of investments, all aimed at helping your money increase in value over time. It’s about making smart choices with your funds, trying to get the best possible return while managing any risks involved. So, there are many avenues to consider beyond just a TIAA CD rate.

Getting Started With Your TIAA Online Access

If you're wondering how to get set up with your TIAA accounts online, it's a pretty straightforward process, actually. Many people find it helpful to manage their money from the comfort of their home, and online access makes that possible. You can register for online access, which opens up a world of possibilities for keeping track of your funds and making adjustments as needed. It’s about making things convenient for you, you know?

Once you're ready to sign in, TIAA provides a secure way to access your account information. They make sure that your personal and financial details are kept safe when you log in, which is, of course, very important. This secure entry point means you can feel confident that your information is protected as you check your balances or make changes. It’s a bit like having a strong lock on your front door, keeping everything secure.

A common question people have is about finding their contract number, which is a key piece of information for your account. TIAA has resources to help you locate this number easily, so you don't have to go digging around too much. Knowing where to find it can save you time and hassle, especially if you need to call them or look up specific details about your plan. Basically, they try to make it simple to find what you need.

Another thing people often want to know is where they can look into how their retirement investments are doing. TIAA offers ways to research the performance of your retirement holdings, so you can see how your money has been growing over time. This transparency is really helpful for understanding your progress and making informed choices about your future. It’s like getting a report card for your investments, showing you how they’re performing.

What If You Need Help With Your TIAA Account?

Sometimes, things don't go quite as planned, and you might run into a temporary snag with service. TIAA understands that these things happen, and if there's an interruption in their service, they are actively working to get things back to normal as quickly as they can. They really do try to resolve any issues that come up, so you can get back to managing your accounts without too much delay. It’s about making sure your experience is as smooth as possible.

They also express regret for any trouble or inconvenience these sorts of interruptions might cause. It’s a way of acknowledging that your time is valuable and that they understand it can be frustrating when you can't access what you need. This kind of apology shows they care about your experience and want to make things right. So, they’re pretty upfront about it when things aren't perfect.

If you find yourself in a situation where service is interrupted, the best thing to do is usually to try again a little later. Often, these issues are resolved fairly quickly. However, if waiting isn't an option or if the problem continues, you can always get in touch with them directly using the telephone numbers they provide. They want to make sure you have a way to reach out for help when you need it, which is good to know.

How Can You Get Answers About Your TIAA Accounts?

For many common questions you might have about your online account, TIAA has put together answers that are easy to find. This means you can often get the information you need without having to call someone, which can save you time. They cover things like what's new with the online tools and how to locate important details like your contract number. It's a bit like having a helpful guide right there when you need it, you know?

They aim to make it simple to understand how to use your online account features and where to find key pieces of information. So, if you're wondering about a particular function or can't remember where a certain number is, chances are the answer is readily available. This focus on clear answers helps you feel more in control of your financial picture. They really try to anticipate what you might ask.

This collection of frequently asked questions is a great resource for getting up to speed on managing your TIAA accounts. It's designed to help you quickly resolve common queries and get on with your day. So, before you pick up the phone, it might be worth taking a quick look there first, as a matter of fact.

TIAA's Promise for Your Retirement Security and the TIAA CD Rate

At TIAA, there's a deep-seated belief that people truly deserve to feel financially secure, especially when they think about their later years. This isn't just a casual thought; it's a fundamental idea that guides their entire approach. They understand that having a sense of safety around your money can bring a lot of peace of mind, which is actually very valuable. It’s about making sure you can live comfortably without constant worry.

Because of this strong belief, they make a specific commitment to their clients. This promise is about helping you build a financial foundation that can stand the test of time, giving you confidence in your future. It’s a pledge to support your journey towards a secure retirement, showing that they are serious about their mission. So, it's more than just a service; it's a real dedication.

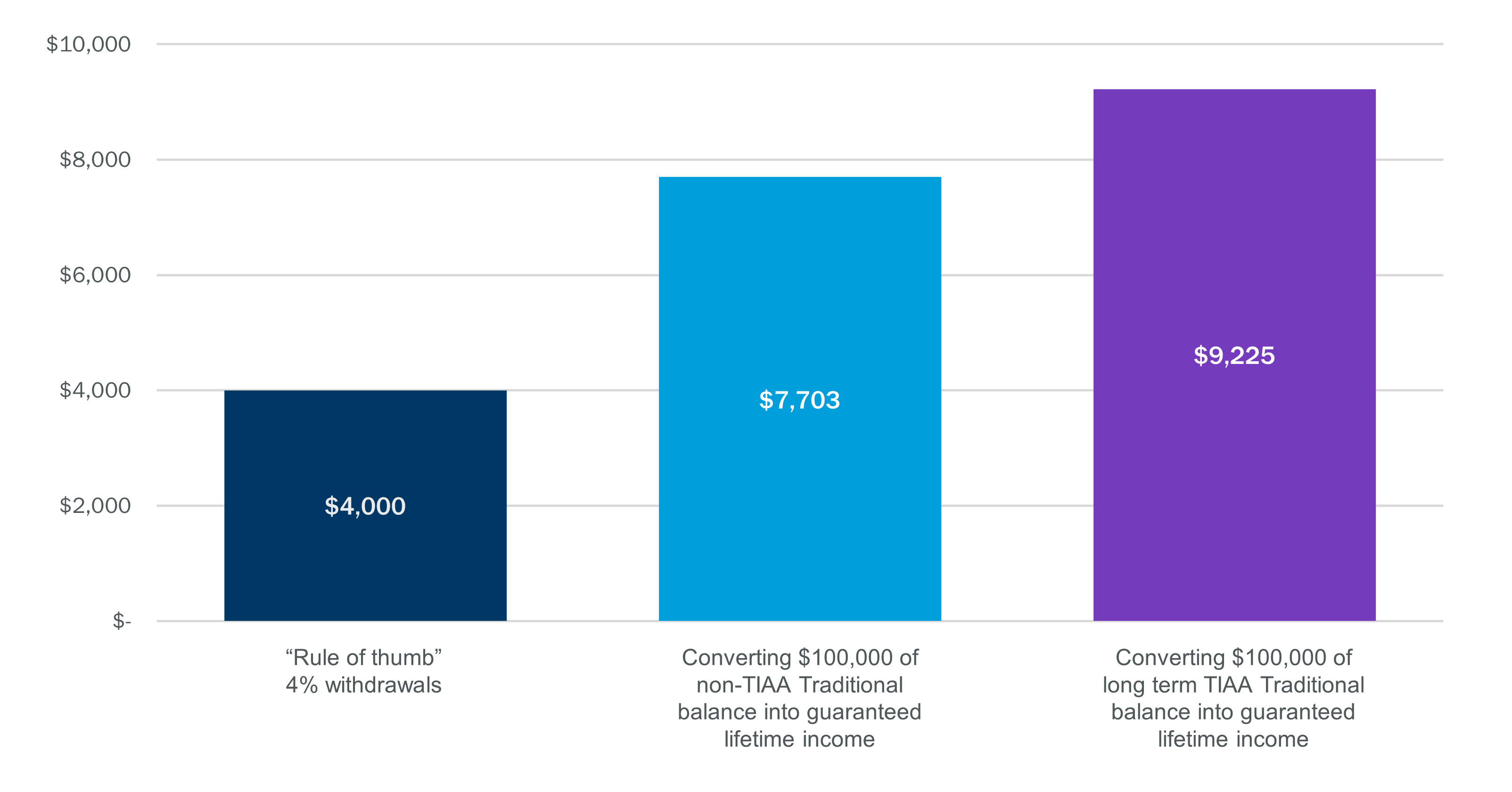

One of the ways they work to keep this promise is by offering a unique kind of security: putting aside a part of your financial resources with TIAA can actually ensure you receive a monthly retirement check for the rest of your life. This means you can have a guaranteed income stream, which is a pretty big deal for many people planning for retirement. It's a bit like having a reliable spring that keeps flowing, providing water whenever you need it.

This kind of guarantee provides a strong layer of protection against the uncertainties that life can sometimes throw our way. Knowing that a portion of your income is secured for as long as you live can really ease concerns about outliving your savings. While some people might look into a TIAA CD rate for shorter-term growth, this long-term income guarantee offers a different kind of financial stability, which is really quite distinct.

Considering TIAA Stable Value and TIAA Access Alongside the TIAA CD Rate

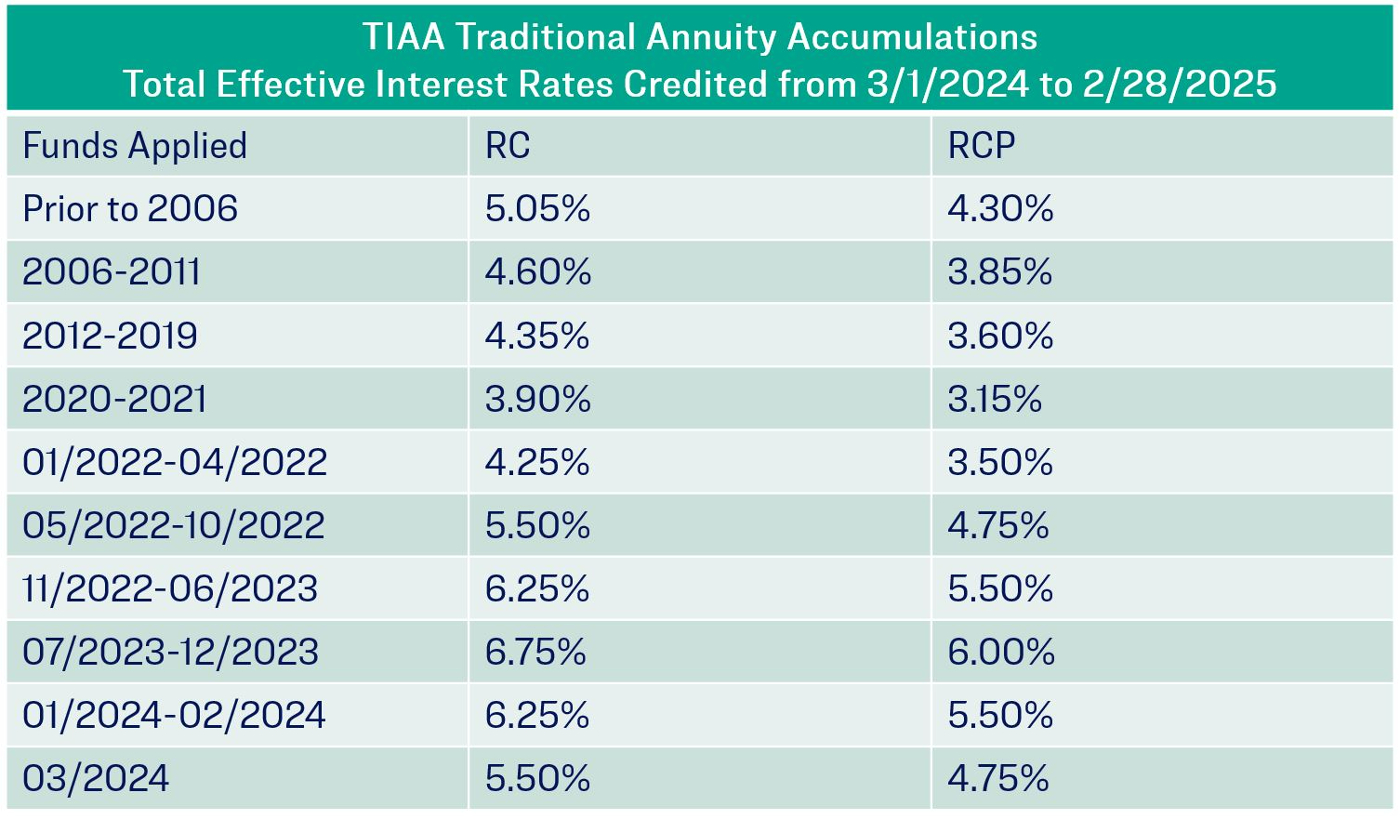

TIAA offers a particular type of fixed annuity called "TIAA Stable Value," which is designed to grow your money consistently, every single day, while you are putting funds aside. This means your savings are always increasing, providing a steady upward trend without the daily ups and downs you might see with other types of investments. It’s a very dependable way to build your nest egg, giving you a sense of calm about your growing funds.

Beyond just growing your savings, this "Stable Value" option also provides the possibility of income for life, similar to the broader promise TIAA makes. So, it’s not just about accumulating money; it’s also about having a plan for how that money will support you once you stop working. This combination of steady growth and lifelong income can be a very attractive feature for many individuals. It's like getting two important benefits wrapped into one, you know?

Then there's "TIAA Access," which is set up to let your money grow along with the market while you are saving. This means your funds have the potential to increase in value when the market performs well, giving you a chance for greater returns. It offers a different approach to growth compared to the fixed nature of "Stable Value," or even something like a TIAA CD rate, which typically offers a set return.

Choosing the right kind of retirement plan and account is, as a matter of fact, a really important step when you're trying to build a financially secure future. There are many different paths you can take, and finding the one that best fits your personal situation and goals is key. It's not a decision to take lightly, as it truly shapes how you'll live later on.

TIAA provides information to help you learn more about their various plan options. This means you can explore the different choices available and see which one aligns best with your vision for retirement. Understanding all your possibilities, from annuities to market-linked accounts, helps you make a choice that feels right for you. It’s about finding the perfect fit for your unique financial puzzle, basically.

Connecting With TIAA Experts for Your Retirement Plan

When you're ready to get started with a retirement plan, or if you just have questions about your options, connecting with a TIAA enrollment expert can be incredibly helpful. These are people who understand the different plans and can explain things in a way that makes sense to you. They are there to guide you through the whole process, making it feel less overwhelming. It's like having a personal coach for your financial journey.

They will walk you through each step, one by one, ensuring you understand what you're doing and why. This step-by-step guidance means you won't feel lost or confused, which can often happen when dealing with financial matters. They really take the time to make sure you're comfortable with every decision you make. So, you're not just left to figure things out on your own.

This personalized approach can make a big difference when you're making important choices about your future. Having someone there to answer your specific questions and help you complete any necessary paperwork can streamline the entire process. It’s about making sure you feel supported and informed as you take these important steps towards a secure retirement. They are pretty dedicated to helping you get set up right.

Whether you're just starting to think about retirement savings, or you're further along in your planning, getting expert advice can be a game-changer. They can help you understand how different options, even something you might have heard about like a TIAA CD rate, fit into your overall strategy. It’s about getting clarity and confidence, allowing you to move forward with peace of mind.

Ultimately, the goal is to help you create a financially secure future that you can look forward to. By connecting with these experts, you're taking a proactive step towards building that future, ensuring you have the right tools and knowledge at your disposal. They are truly there to assist you in making smart choices for your long-term well-being.

This article has explored how TIAA aims to help individuals secure their financial future, touching

Tiaa Cd Rates 2025 - Clem Yolanda

Tiaa Cd Rates 2025 - Clem Yolanda

Log In Tiaa