TIAA CD Rates Today - A Look At Your Money Options

When you are thinking about your financial future, especially retirement, knowing where your money stands is, you know, pretty important. It’s a bit like keeping track of your daily steps; you want to see how far you have come and what progress you are making. For many people, TIAA is a name that comes up often when they think about their long-term savings and plans for later in life, so it makes sense to look into how things work there.

You might be wondering about different ways to put your money to work, perhaps looking into things like certificates of deposit, or CDs, and what TIAA might offer in that area. While we are focusing on general account features and retirement planning options here, knowing how to access your information and understand your choices is a good first step, anyway. It’s about getting a clear picture of what is available to you, and how you can manage it.

Getting a handle on your money means being able to see what you have, make choices about where it goes, and get some good advice along the way. TIAA aims to help with all of that, offering ways for you to keep an eye on your funds and plan for what is ahead. It is, basically, about giving you the tools to feel more secure about your financial path, especially when you are thinking about your later years.

Table of Contents

- What Can You See with Your TIAA Account?

- How Do You Get Started with TIAA Online Access, and Your TIAA CD Rates Today Inquiries?

- Thinking About Your Retirement Future?

- What Makes TIAA Stable Value an Option for Your Money, Perhaps Even for TIAA CD Rates Today Considerations?

- Are There Other Ways TIAA Helps with Saving, Beyond Just TIAA CD Rates Today?

- Where Can You Find Answers About Your TIAA Account, Maybe Even About TIAA CD Rates Today?

- How Does TIAA Help You Plan for What's Next?

- Connecting with an Expert About Your TIAA Account and Potential TIAA CD Rates Today

What Can You See with Your TIAA Account?

Having a TIAA account means you get a way to look at your money situation, which is really helpful for anyone trying to plan for the future. You can, for instance, check your balances, which is just seeing how much money you have in your accounts at any given moment. This simple act of checking your balance can give you a lot of peace of mind, or maybe, you know, a clear picture of what needs more attention. It’s about being informed, basically, about your financial standing.

Beyond just looking at numbers, your TIAA account also gives you a way to manage your investments. This means you can make choices about where your money is put, maybe adjusting things as your life changes or as you get closer to retirement. It’s not just about setting it and forgetting it; it’s about having the ability to steer your financial ship, so to speak. This kind of hands-on ability can make a big difference in how your money grows over time, which is pretty important for long-term goals.

And then there is the part about getting advice. Sometimes, even with all the information in front of you, it helps to talk to someone who knows a lot about money matters. TIAA accounts give you access to guidance, which can be really useful when you are trying to figure out the best path for your savings or what steps to take next. It’s like having a knowledgeable person to bounce ideas off of, which can certainly make complex decisions feel a bit simpler.

How Do You Get Started with TIAA Online Access, and Your TIAA CD Rates Today Inquiries?

To get to all these helpful features, you will need to get into your TIAA account online. There is a secure login area for this, which helps keep your personal financial information safe. It is, you know, a very important step to make sure only you can get to your details. If you are just starting out with TIAA online, you might have some questions about how to register for access, which is totally normal.

A common question people have when they are trying to get set up online is where to find their contract number. This number is a key piece of information for identifying your account, and you will need it for various things, including getting online access. Knowing where to locate this can save you a good bit of time and effort when you are trying to get things sorted out, so it is a good thing to keep in mind.

Once you are in your account, you might want to look into how your retirement investments are doing. People often ask where they can research the performance of these investments, and the online platform usually has tools for this. Seeing how your money is performing can give you insights into whether your current strategy is working for you, and if you are thinking about different options like TIAA CD rates today, understanding your current portfolio is a good first step, honestly.

Thinking About Your Retirement Future?

TIAA holds a strong belief that everyone should have a secure retirement. This idea is, you know, at the core of what they do. It is about making sure that when you stop working, you have enough money to live comfortably and without a lot of worry. This belief shapes the kinds of solutions and support they offer, aiming to help people build a solid financial foundation for their later years, which is a pretty comforting thought for many.

To help people reach that secure retirement, TIAA offers a variety of ways to save and manage money. You can look into their annuities, which are a way to turn a lump sum of money into regular payments later on. They also have different retirement plans, which are setups for saving over time, often through your workplace. These plans are, basically, designed to help you build up a nest egg bit by bit, which is a smart way to approach long-term saving.

Beyond specific products, TIAA also offers financial planning services. This is where you can get help putting together a complete picture of your money, setting goals, and making a plan to reach them. They also deal with investing and wealth management solutions, which are about helping your money grow and making sure it is looked after carefully. All these options are there to give you different paths to a financially sound future, so you know, there is a lot to consider.

What Makes TIAA Stable Value an Option for Your Money, Perhaps Even for TIAA CD Rates Today Considerations?

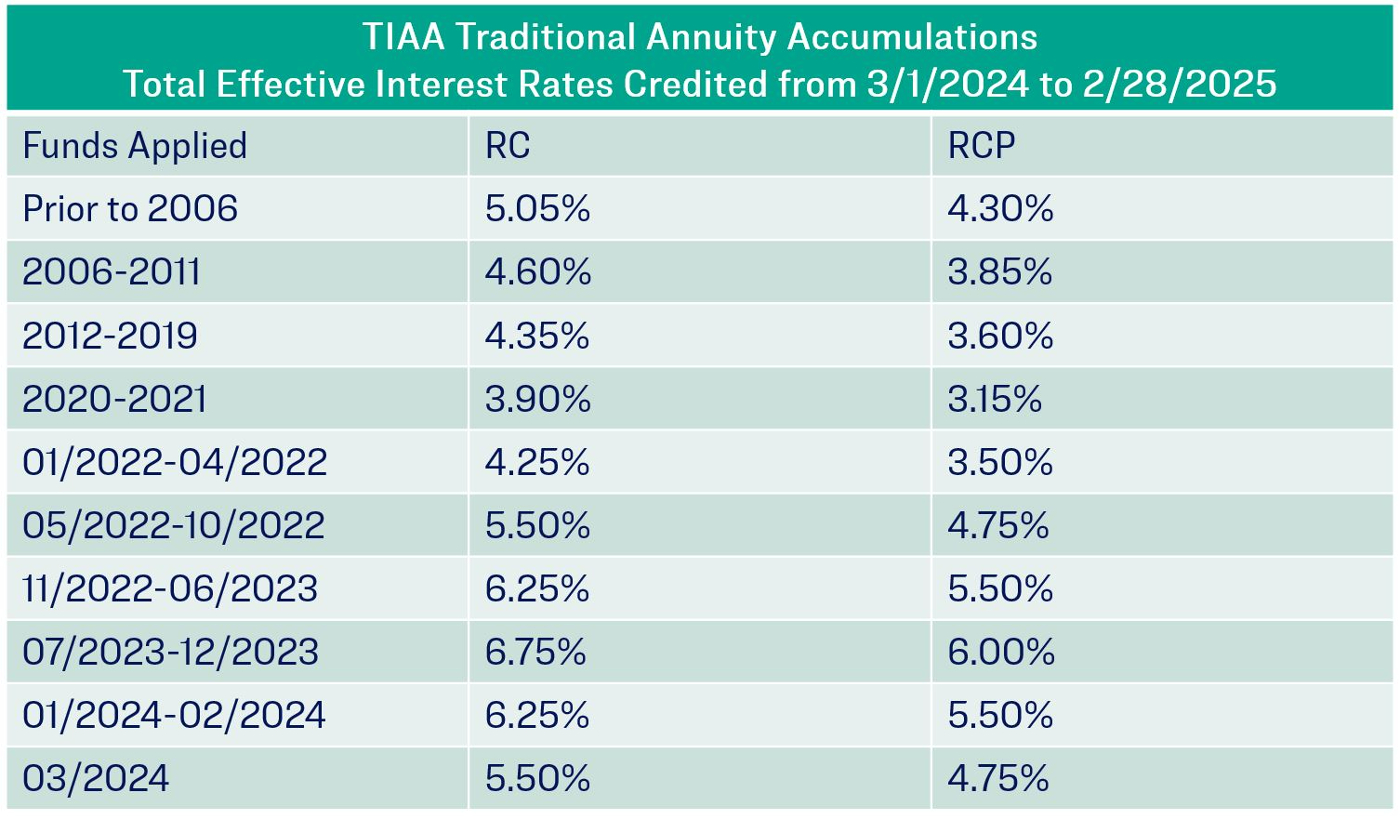

One particular option TIAA talks about is something called TIAA Stable Value. This is a kind of fixed annuity that has a guarantee built in: it is supposed to grow every single day while you are saving. For people who like a bit more certainty with their money, this can be quite appealing. It is about consistent growth, which can be a good thing for long-term savings plans, especially if you are looking for something that is less affected by daily market ups and downs.

And, just like other options that aim for long-term income, TIAA Stable Value also offers the chance for income that lasts for your whole life. This is a significant feature for retirement planning, as it means you could have a steady stream of money coming in for as long as you live, which is a very reassuring idea for many. It is a way to help make sure your money does not run out, which is pretty much what everyone wants for their retirement.

There is also something called TIAA Access, which is set up to grow along with the general market while you are putting money away. This kind of option is different from a fixed annuity because its value can go up and down with the market, offering a different kind of growth potential. Both Stable Value and TIAA Access are examples of the different ways TIAA helps people save for their future, and understanding these differences can help you make choices that fit your comfort level with risk and your financial goals, like how you might think about TIAA CD rates today, for example.

Are There Other Ways TIAA Helps with Saving, Beyond Just TIAA CD Rates Today?

Picking the right retirement plan and the right kind of account is a really big step when you are trying to build a secure financial future. It is not just about putting money away; it is about choosing the right vehicle for that money to grow and to be there when you need it. TIAA has different plan options, and taking the time to learn about them can really make a difference in how well your savings strategy works out over the years.

Sometimes, there might be a temporary hiccup in service, and TIAA lets people know about it. They work to fix these issues as quickly as they can, and they usually apologize for any trouble it causes. If you ever run into something like this, they typically suggest trying again a little later or reaching out to them directly using their phone numbers. It is, you know, a way of keeping people informed when things are not running perfectly, which is pretty straightforward.

The idea of security is a big deal at TIAA. They really believe that people deserve to feel secure about their money, and so they make a sort of promise around that. This promise means that if you put some of your assets with TIAA, you could be guaranteed to get a monthly retirement check for as long as you live. This kind of guarantee is a powerful thing for retirement planning, offering a steady income stream that you can count on, which is a very comforting thought, honestly.

Where Can You Find Answers About Your TIAA Account, Maybe Even About TIAA CD Rates Today?

For common questions about your online account, there are usually places to find answers. This includes information about what might be new with the online system or where you can locate your contract number, which, as we talked about, is pretty important. These resources are there to help you get the most out of your online experience and to quickly resolve any small questions you might have about managing your money, or even looking into things like TIAA CD rates today.

How Does TIAA Help You Plan for What's Next?

When it comes to planning for your future, especially your retirement, having a clear path can make all the difference. TIAA offers various ways to help you think through what you need and what steps to take. It is about making sure you have the right kind of support to put your financial strategy into action, which is, you know, a big part of feeling ready for retirement. They aim to make the process of setting up your financial future as clear as possible.

Connecting with an Expert About Your TIAA Account and Potential TIAA CD Rates Today

If you are feeling a bit unsure about getting started or just want some personal guidance, you can connect with a TIAA enrollment expert. These experts are there to walk you through the whole process, step by step. This kind of one-on-one help can be incredibly useful, especially if you are new to saving for retirement or have specific questions about your options, like perhaps about TIAA CD rates today, and just want someone to explain things in a way that makes sense to you. They can help make sure you are on the right track from the very beginning.

Tiaa Cd Rates 2025 - Clem Yolanda

Tiaa Cd Rates 2025 - Clem Yolanda

Tiaa Cd Rates 2025 - Clem Yolanda