MPDU For Sale - Finding Your Next Home

Finding a place to call your own can feel like a big adventure, especially when you are looking for something that fits your family's needs and budget. Sometimes, the idea of owning a home seems out of reach, but there are programs out there that help make it more possible. One such program involves what are called Moderately Priced Dwelling Units, or MPDUs, and these can be a real opportunity for many households.

When you hear about an "MPDU for sale," it points to a special kind of home ownership chance, usually set up by local government efforts to keep housing affordable. These homes are meant for people who meet certain income guidelines, making sure that good places to live are available to a wider range of folks in the community. It is a way to help people put down roots and feel more secure in their living situation, which, you know, is really important for everyone.

So, if you have been thinking about buying a house and wondered if there might be a path for you, learning about MPDUs could be a very good next step. These units come up for purchase now and then, and knowing how they work can help you be ready when one becomes available. It is all about understanding the process and being prepared to act when the time is right, which, to be honest, can make all the difference.

Table of Contents

- What Does "MPDU for Sale" Really Mean for You?

- How Do You Start Looking for an MPDU for Sale?

- What Other Financial Pieces Do You Need for an MPDU for Sale?

- What Are the Ongoing Costs of an MPDU for Sale?

- When Can You Apply for MPDU Programs?

- Thinking of Selling Your MPDU Home?

- The Private Side of MPDU for Sale Transactions

- The Offering Agreement - A Key Step for MPDU for Sale

What Does "MPDU for Sale" Really Mean for You?

When you hear about an MPDU, or Moderately Priced Dwelling Unit, it refers to homes that are kept at a price that is easier for more people to afford. These are often part of local programs designed to make sure that a good mix of housing is available in different areas. So, if you see an "MPDU for sale" sign, it means a home is available through one of these special programs, usually with specific rules about who can buy it and for how much. It is not just any house on the market; it is a home with a purpose, you know, to help with housing affordability.

These homes are usually offered to households that meet certain income levels. The idea is to help people who might struggle to buy a home at market rates still have a chance to own property. This can be a huge benefit for families looking to settle down and build some stability. It is, basically, a way for communities to support their residents, making sure everyone has a fair shot at home ownership, which is pretty cool.

Sometimes, people might think these homes are somehow lesser, but that is not the case at all. They are just regular homes that are part of a program to keep prices fair. So, if you are seeing an MPDU for sale, it is worth looking into if you fit the income requirements. It could be a really good fit for your family's future plans, and that, is that, a very important thing to consider.

How Do You Start Looking for an MPDU for Sale?

Starting your search for an MPDU for sale often begins with knowing where to look. While you might use websites like Zillow to see homes generally, keeping an eye on specific program websites is key for MPDUs. For instance, in a place like the 21222 area, you might find a good number of homes listed on Zillow, complete with pictures and sales details. You can even use the site's helpful filters to narrow down your choices and find a place that feels just right for you and your people.

But for MPDU homes specifically, the process is a bit different. Households who want to rent or buy an MPDU unit are usually told to watch a particular website for news about when waiting lists open up and when units become available. This means you have to be a bit proactive and regularly check for updates. It is not always as simple as just browsing a general real estate site, you know, because these are special listings.

So, if you are serious about finding an MPDU for sale, make it a habit to visit the relevant housing program's official website. These sites are the best source for the most current information. They will tell you when you can apply and what homes are actually ready for new residents. It is a bit like waiting for a special announcement, and being ready to act quickly once it happens, which, you know, is important.

What Other Financial Pieces Do You Need for an MPDU for Sale?

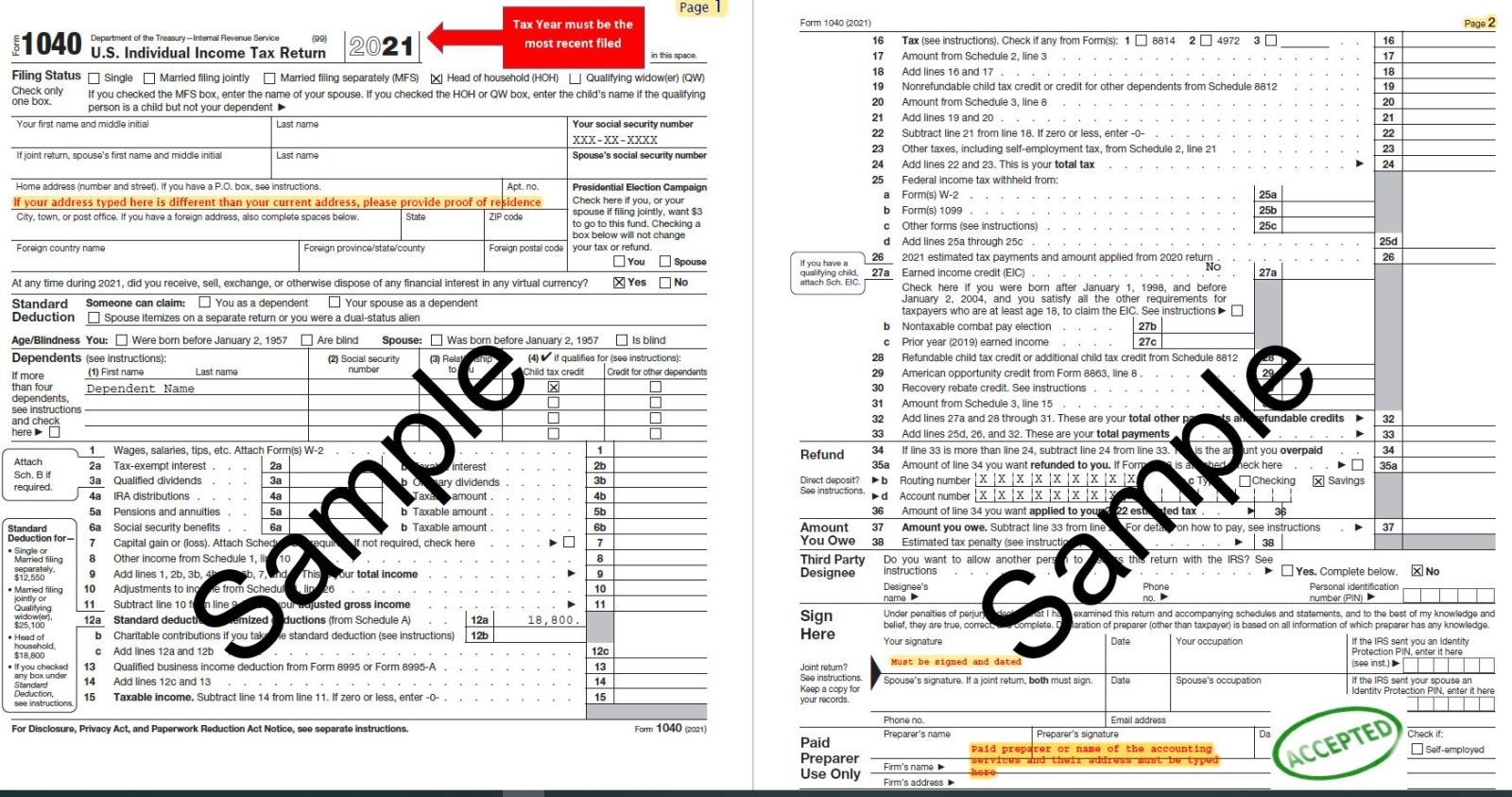

When you think about buying an MPDU for sale, it is natural to wonder about all the money matters involved. Beyond just the purchase price, people often ask what other financial things an applicant needs to have ready. It is not just about having enough for a down payment or getting a loan; there are other pieces to the financial puzzle that you need to put together. This might include showing that you have some savings, or perhaps a steady job that provides a good income. Basically, you need to show that you are in a solid financial position to take on home ownership, which is, you know, a pretty big commitment.

Sometimes, programs might look at your overall financial picture, not just your income. They might want to see if you have other assets, like money saved in a bank account, or if you have a good record of paying your bills on time. This helps them know that you can handle the responsibilities of owning a home. So, it is a good idea to get all your financial papers in order before you even start the application process for an MPDU for sale. Being prepared can make a real difference in how smoothly things go, and that, is that, something to think about.

It is also worth noting that you do not need to be a U.S. citizen to apply for some of these programs. The focus is usually on household income and other financial stability factors, rather than citizenship status. This opens up the possibility of home ownership to a wider group of people, which, you know, is a very good thing for communities. So, do not let that particular thought hold you back from exploring your options for an MPDU for sale.

What Are the Ongoing Costs of an MPDU for Sale?

Buying an MPDU for sale means thinking about more than just the monthly mortgage payment. Many people wonder what other regular costs they will need to pay if they buy an MPDU. It is a very good question, because home ownership comes with a bunch of other bills that add up. These can include things like property taxes, which are paid to the local government, and homeowner's insurance, which protects your home from unexpected events. You might also have to pay for utilities, like electricity, water, and gas, and maybe even a homeowners association fee if the property is part of a community with shared spaces. So, you know, it is not just one bill.

Then there are the costs of keeping up the home itself. Things break, and things need fixing. You might need to pay for repairs, like a leaky roof or a broken appliance. There are also regular maintenance tasks, such as lawn care or cleaning gutters. These can be small costs here and there, but they can also be quite large if something major happens. It is a good idea to set aside some money each month for these kinds of unexpected expenses. Basically, owning a home means being ready for all sorts of things that come up, which, to be honest, can be a lot to keep track of.

Understanding all these additional costs upfront is really important. It helps you create a realistic budget and avoids any surprises down the road. So, when you are looking at an MPDU for sale, try to get a clear picture of what the total monthly outgoings will be, not just the mortgage. This way, you can make a decision that is truly right for your financial situation and feel confident about your new home. It is, after all, a very big step.

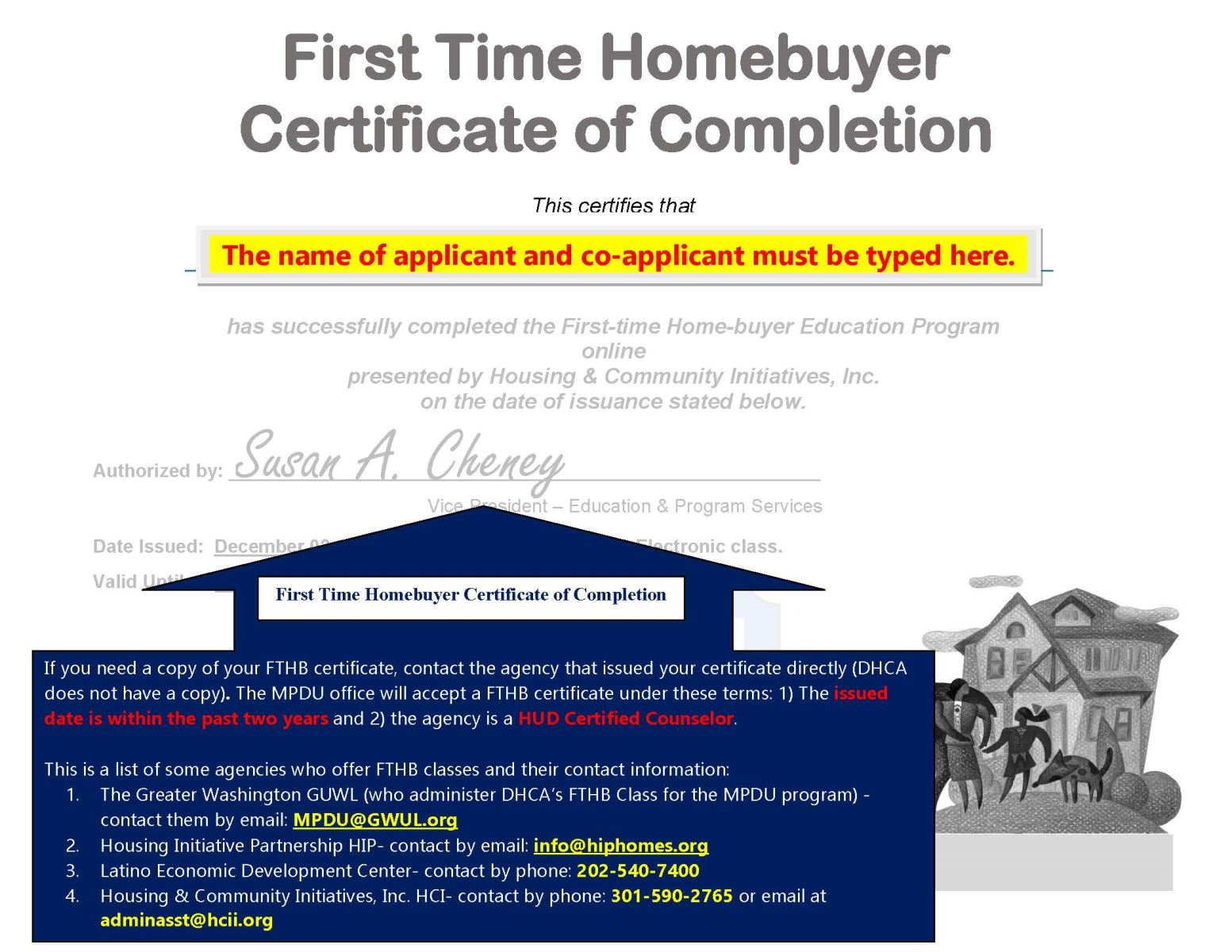

When Can You Apply for MPDU Programs?

Getting into an MPDU program means knowing when to apply. The timing for these programs can vary, and it is usually announced by the local government or housing authority. For example, some programs, like the Focused Neighborhood Assistance (FNA) program run by the neighborhood revitalization section, community development division, start accepting online applications at specific times. For that one, the date was set for May 1, 2025. This means you need to be aware of these dates and be ready to submit your application when the window opens. It is not something you can just do any time, you know.

Staying informed about these application periods is really important. The websites of the relevant housing departments are your best source for this information. They will post updates on when new opportunities are available, or when waiting lists might be opening up. It is a bit like keeping an eye on a schedule; you want to make sure you do not miss your chance. So, regularly checking these official sources is a pretty good habit to get into if you are serious about an MPDU for sale.

Sometimes, these application periods are quite short, or they might only accept a certain number of applications. This makes being prepared even more critical. Having all your documents ready and knowing how to fill out the online forms can save you a lot of time and stress when the application period begins. It is, basically, about being organized and ready to move quickly when the opportunity comes up, which, you know, can make all the difference.

Thinking of Selling Your MPDU Home?

If you are already a homeowner in the MPDU program and you are thinking about selling your home, there are specific steps you need to follow. It is not quite the same as selling a regular house on the open market. You usually have to complete a special form, often called an MPDU resale/refinance request form. This form tells the program administrators that you are planning to sell, and it helps them guide you through the rules that apply to MPDU properties. So, you know, it is a bit of a process.

The rules for selling an MPDU are in place to make sure the home stays affordable for the next eligible buyer. This means there might be limits on the selling price or requirements about who you can sell to. The owner also has to provide certain information to the city or the housing authority. This information helps them keep track of the affordable housing stock and ensure the program's goals are met. It is, basically, about keeping the spirit of the program alive for future residents, which is a good thing.

It is really important to get in touch with the program administrators early in your selling process. They can give you all the necessary forms and explain any specific rules that apply to your situation. This helps you avoid any issues and makes sure your sale goes smoothly. So, if you have an MPDU for sale in mind, reach out to the program office first; they are there to help you through it, and that, is that, a very helpful resource.

The Private Side of MPDU for Sale Transactions

When it comes to buying or renting an MPDU, the actual process of the sale or rental is usually a private deal. This means it happens directly between the person applying for the unit and the current owner, or the "MPDU certificate holder." While a planning and zoning department might confirm that program participants are eligible and provide some guidance, they do not usually get involved in the direct buying and selling part. It is more like a typical real estate transaction in that sense, just with specific rules around who can participate, you know.

This private arrangement means that you, as an applicant, will be working with the seller or their real estate agent directly. You will negotiate the terms, sign contracts, and handle the closing just like you would with any other home purchase. The program administrators are there to make sure everyone is playing by the rules, especially when it comes to eligibility and pricing, but they do not act as the real estate agents themselves. So, you know, it is still a very personal kind of transaction.

It is important to remember that even though it is a private transaction, the rules of the MPDU program still apply. You cannot just buy or sell an MPDU for sale to anyone at any price. The program's guidelines are there to ensure the affordability goal is met. So, while you are dealing directly with the other party, the overarching program structure is always there, guiding the process, and that, is that, something to keep in mind.

The Offering Agreement - A Key Step for MPDU for Sale

For developers or builders who are making MPDUs available, there is a very important document called an offering agreement. This agreement is given to the housing authority once the developer is ready to put the MPDUs up for sale or rent to people who have been approved by the program. It is a formal way of saying, "These homes are now ready for eligible buyers or renters," and it kicks off the process of getting families into these units. So, it is, basically, a really big step in the whole MPDU for sale process.

This offering agreement usually contains all the important details about the MPDU units, like their location, how many there are, and the specific terms for their sale or rental. It helps the housing authority keep track of the available affordable housing stock and ensures that everything is done according to the program's rules. Without this agreement, the units cannot officially be offered to those who qualify. It is a bit like a formal announcement that these homes are ready for their new occupants, which, you know, is pretty exciting for everyone involved.

The submission of this agreement means that the developer has finished building or preparing the units and is now handing them over, in a sense, to the program for distribution. It is a sign that the MPDU for sale units are truly ready for people to start moving into. This step is a crucial part of making sure that affordable housing becomes a reality for families who need it. It is, after all, a very important part of the entire journey.

Mpdu For Sale In Montgomery County Md

DHCA MPDU > MPDU Application Tutorial and Portal

MPDU Purchase Applicants - Housing and Community Affairs - Montgomery